내 수취인 정보 추가 또는 변경

새 수취인을 추가하거나 은행 기록, 선호하는 결제 수단 및 선호하는 세금 양식을 포함한 기존 수취인 정보를 변경합니다.

참고 : 일단 설정된 수취인 계정은 닉네임을 변경하거나 삭제할 수 없습니다. 하지만 언제든지 수취인 계정 정보를 업데이트하여 결제 세부 정보를 조정할 수 있습니다.

- GoDaddy 내 프로필 페이지로 이동합니다. 로그인하라는 메시지가 표시 될 수 있습니다.

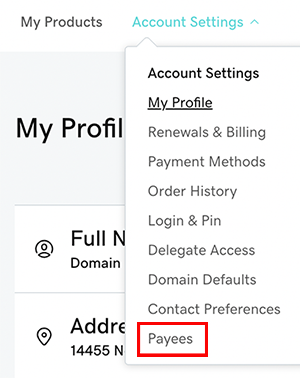

- 계정 설정 을 선택한 다음 수취인 을 선택합니다.

- 새 수취인을 추가할지 아니면 기존 수취인 계정을 업데이트할지 선택합니다.

- 새 계정을 추가하려면 수취인 추가 를 선택합니다. 계정의 닉네임 (나중에 변경할 수 없음)을 입력 한 다음 추가 를 선택합니다.

- 기존 계정을 편집하려면 업데이트 할 계정 옆에있는 보기 / 편집 을 선택합니다. 결제 세부 정보 입력 화면 에서 편집 을 선택합니다.

- 주소 섹션에서 계정 유형 (개인 또는 회사), 이메일 주소, 전화 번호, 이름 및 우편 주소를 입력하거나 편집합니다. 일부 항목은 추가 정보가 필요할 수 있습니다.

- 이 섹션에는 실제 주소가 필요하며 사서함은 없습니다. 미국 고객은 수표를 사서함으로 보내도록 할 수 있지만, 반드시 당사에 문의해야합니다. GoDaddy 가이드 .

- 귀하의 은행 계좌가 GoDaddy 계정에 지정된 국가에 있지 않은 경우 당사에 문의하십시오. GoDaddy 가이드 .

- 완료되면 다음을 선택합니다.

- 주소를 확인할 수 없다는 알림이 표시되면 주소를 검토하세요. 올바른 경우 확인 및 계속 을 선택하고 주소를 변경하려면 주소 편집 을 선택합니다.

- 결제 방법 섹션의 드롭 다운 목록에서 결제 방법을 선택하고 필요한 은행 정보를 입력합니다. 이 섹션을 완료 할 때 염두에 두어야 할 몇 가지 사항이 있습니다.

- 결제 수단으로 PayPal을 선택한 경우 PayPal 프로필에 표시된대로 성과 이름을 정확하게 입력합니다. 중간 이름이 PayPal 프로필에있는 경우 성 필드에 추가해야 할 수 있습니다.

- 임시 결제를 보류하려면 결제 방법 목록에서 내 결제 보류를 선택합니다. 이 선택을 변경할 때까지 결제가 보류됩니다.

- 결제 수단 아래에서 결제 기준 액 편집 을 선택하고 목록에서 값을 선택하여 결제를 트리거하는 최소 금액을 설정합니다. 기본 금액을 사용해도 괜찮 으면 아무것도 변경할 필요가 없습니다.

참고 : 다음은 지급 기준 액 및 거래 수수료에 대한 정보 입니다.

- 완료되면 다음을 선택합니다.

- 세금 양식 섹션에서 IRS 양식 W-9를 작성합니다. 필수 : 이 단계를주의 깊게 읽으십시오. 당사의 타사 결제 프로세서 인 Tipalti는 귀하가 양식 W-9에 제공 한 정보를 IRS 데이터베이스의 정보와 대조합니다. 이름과 TIN을 확인할 수없는 경우 올바른 정보가있을 때까지 결제가 보류됩니다. 자세한 내용은 다음을 참조하세요.수취인에 대한 세금 확인이란 무엇인가요?

- 개인 인 경우 :

- 이름 필드에 IRS 세금 문서에있는 이름을 정확하게 입력해야합니다.

- 주소 정보를 입력하십시오.

- 파트 I : 납세자 식별 번호 섹션 (아래로 스크롤하여 확인)에서 사회 보장 번호 (SSN) 를 입력합니다.

- 파트 II : 인증 섹션에서 양식 W-9에 (전자 방식으로) 서명하려면 이름과 이메일 주소를 입력합니다. 이름 및 이메일 주소는 4 단계에서 제공 한 이름 및 이메일과 일치해야합니다.

- 또는 비즈니스에 필요한대로 선택하십시오.

- 귀하가 법인 (비 개인) 인 경우 :

- 이름 필드에 IRS 세금 문서에있는 법인 이름을 정확하게 입력해야합니다 (예 : "MyCoolBusiness LLC"). 여기에서 "DBA (Doing Business As)"이름을 사용하지 마십시오. 유효성 검사에 실패합니다.

- 주소 정보를 입력하십시오.

- 파트 I : 납세자 식별 번호 섹션 (아래로 스크롤하여 확인)에서 IRS에서 제공 한 EIN (고용주 식별 번호 )을 입력합니다.

참고 : EIN이 있는지 확실하지 않지만 비즈니스에 대한 수수료입니까? IRS 웹 사이트에서 EIN을 신청하는 방법에 대해 알아보십시오 . - 파트 II : 인증 섹션에서 양식 W-9에 (전자 방식으로) 서명하려면 이름과 이메일 주소를 입력합니다. 이름 및 이메일 주소는 4 단계에서 제공 한 이름 및 이메일과 일치해야합니다.

- 또는 비즈니스에 필요한대로 선택하십시오.

참고 : 미국 수취인이지만 미국 시민이 아닌 경우 개인용 W-8 세금 양식 (또는 회사의 경우 W-8 세금 양식 )을 작성하라는 메시지가 표시됩니다. 추가 정보가 필요한 경우 규정 준수 팀에서 제출 후 몇 시간 내에 확인하고 연락을드립니다.

- 개인 인 경우 :

- 세금 양식 작성을 모두 마쳤 으면 다음 을 선택하고 다음 화면에서 완료 를 선택합니다.

관련 단계

수취인 계정을 설정할 때 사용하려는 제품에 수취인을 연결합니다. 필요한 각 제품에 대해 아래 링크를 사용하세요.

- 리셀러 : 내 리셀러 스토어를 설정합니다 . 설정된 후에는 다른 수취인으로 전환 할 수 없지만, 언제든지 수취인 계정의 정보를 편집 할 수 있습니다.

- CashParking : 수취인을 내 CashParking 계정에 연결합니다 .

- GoDaddy 경매 : GoDaddy 경매 계정 설정 편집

- 판매 할 도메인 등록 : List for Sale을 사용하여 내 도메인을 판매 합니다.

상세 정보

- 수취인 정보 또는 세금 양식 상태 업데이트와 같은 계정 활동에 대한 이메일 알림을 보내드립니다.

- 귀하에게 적합한 결제 방법을 결정하는 데 도움이 필요하면 비즈니스 또는 세무 변호사와 상담하는 것이 좋습니다.

- 추가 정보를 제공하기 위해 규정 준수 팀에서 연락하는 경우, 수취인 계정 보기 / 편집 단계를 따르세요. 더 많은 정보를 추가하고 사진 ID를 업로드하라는 메시지가 표시됩니다.

- 세금 확인 과정 에 대해 자세히 알아보세요.